Showing: 82 items

Refine By

April 01, 2024 | by Diebold Nixdorf

Explore case studies and learn how your peers leverage Diebold Nixdorf banking products and services for their success.

May 03, 2021 | by Ludwig Simoen

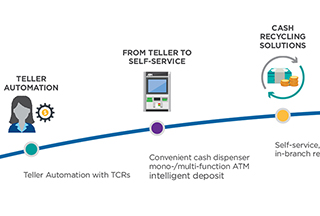

In a cash recycling scenario, your own consumers are replenishing your ATMs for free. Are you taking advantage of it?

April 27, 2021 | by Scott Weston

One of the very first questions we always ask banks and credit unions is this: What is the role of the ATM within your network? In pop culture terminology, you might call it “defining the relationship” (DTR)... and it’s not always as easy to answer as you might think.

April 22, 2021 | by Diebold Nixdorf

Diebold Nixdorf's sustainability program includes industry-leading 'green' products and solutions for customers in banking and retail, a sustainable supply chain and continued reduction of the company's energy consumption and carbon footprint through optimized facility organization.

April 19, 2021 | by Ludwig Simoen

Financial Institutions have many opportunities to finance green initiatives and lessen their impact on the environment. Let’s take a closer look at how your organization can reduce your carbon footprint, “green” your physical channels and encourage more sustainable actions across your entire omnichannel network. Where do you stack up against these five action plans?

April 19, 2021 | by Diebold Nixdorf

See how to make your self-service network more sustainable, efficient and future-proof for a changing world.

April 16, 2021 | by Diebold Nixdorf

Security matters more than ever before. Diebold Nixdorf, the leader in connected commerce, ensures every experience and connection is secure from the back-end to your end user. Multi-layered, tested, verified, and audited, our solutions ensure the highest security quality.

February 05, 2021 | by Diebold Nixdorf

As part of America First Credit Unions’ fleet upgrade initiative, they will implement VynamicTM Payments software to transform their terminal driving and transaction switching capabilities, along with installing DN SeriesTM ATMs to offer new member-centric experiences and more secure banking interactions to its members.

November 09, 2020 | by B. Scott Harroff

While fraud comes in all shapes and sizes, during the pandemic, criminals switched up some of their tactics. With stay-at-home orders and travel restrictions in effect in-person, ATM attacks actually dropped. In contrast, online, cyber-based attacks increased. As we see economies reopen, stay-at-home orders expire, and travel restrictions lift, in-person fraud is beginning its uptick once again. And that means you need to be armed with the best possible protections.

September 28, 2020 | by Scott Weston

Merely having a deposit-accepting ATM is no longer the most efficient, convenient or fulfilling option for transaction migration. It simply isn’t a good experience for consumers or branch employees, and the cost to FIs for balancing is cumbersome. Deposit Automation technology creates the best overall experience and efficiency for migrating transactions out of the branch… especially with the acceleration of our dependence on self-service through COVID.

June 25, 2020 | by Thomas Schulze

June 27 marks the 53rd anniversary of the world's first ATM. While common by today's standards, in 1967 the machine's debut drew crowds from all over. Little did many people realize the impact this technology would have, as it became one of the first innovations to radically shape the financial industry and consumer's daily lives forever.